Fully Insured vs Self-Funded

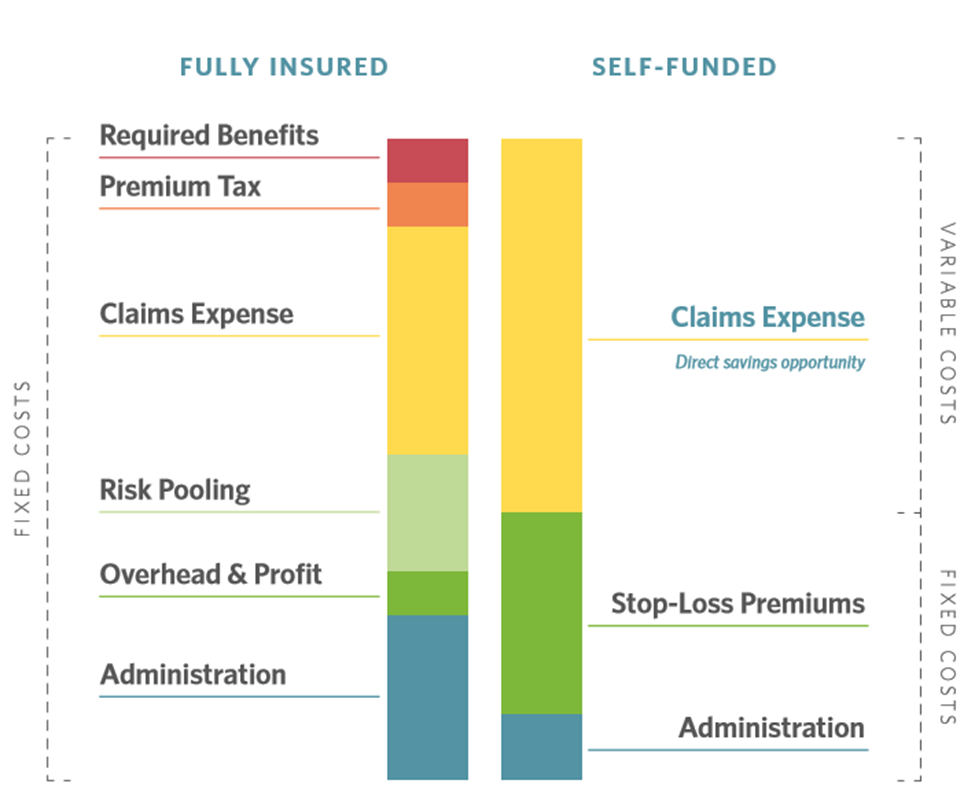

It is the opinion of our advisors that self-insurance provides greatest ability to maximize savings, build an ideal plan design and improve outcomes for members. Large employers that elect to partially self-insure group health understand they are absorbing part of their employee health care risk. Specific and Aggregate stop loss insurance provide a protection against high-claimants and for the population as a whole.

Rather than pay a fixed amount for the entire year under a fully-insured plan, employers pay a smaller fixed cost that includes the stop loss insurance, admin and advisor fees, network access and a variety of other services; many of which they are paying today but are not itemized under a fully insured plan.

Employers that self-insure benefit greatly from the BritePath benefit strategy. Every claims dollar saved is retained by the employer rather than the insurance company. Employers that elect to level-fund will receive all or part of the savings in the form of a rebate.

Advantages of Self-Funding

Transparency & Cost Control

BritePath benefit strategy focuses on lowering the average unit cost of member medical and prescription drug costs. Employers that choose to use an alternative funding approach with an independent TPA have exceptional ability to reduce and mitigate outlier claims, as well as services with higher utilization like radiology, inpatient and ambulatory surgery, prescriptions and maintenance drugs. Solutions such as those listed below can be bundled or on the ready when needed as part of the seamless member experience.

- Strategic Benefit Plan Design

- Independent Third-Party Administration

- Transparent Pharmacy Benefits

- Centers of Excellence Networks

- Second Medical Opinions

- Reference Based Pricing

- Script Sourcing

- Independent Medical Management

- Independent Telemedicine

- Direct or Virtual Primary Care

- Direct Contracting

- Bundled Pricing

- Medical Tourism

- BritePath Rewards

- BritePath Insights

- Member navigation tools and technology

Selecting the right TPA

Think of the TPA as the band leader. An ideal TPA will be transparent, patient focused and cost-control driven; always focused on ensuring members receive the highest-quality care at a fair price. An ideal TPA will provide actionable data in real-time so employers and their members can act before, not after, a service is rendered. Data analytics will detect which services an employer might implement at a future date or immediately. Top TPA’s include transparent PBM contracts and exceptional Medical Management as par of their core solutions. These components provide significant savings with little-to-no disruption for members.

Pharmacy Benefit Management

A transparent PBM will work with manufacturers and pharmacies to secure the best pricing, rebates and discounts possible on behalf of our clients. In a traditional arrangement, the PBM may retain all or part of the rebates, take a spread and/or charge the client more than the pharmacy was paid. A truly pass-through PBM will pass 100 percent of all discounts or rebates they receive directly back to the client which can reduce the pharmacy spend by 25-40%. Employers will have unrestricted visibility down to the claim and invoice level for better tracking and monitoring. In addition, the PBM will make sure the Rx formulary is structured to benefit the members and employer.

Medical Management

Medical management programs can be tailored to the unique specifications of each individual group. Understanding the client’s culture, population, goals, objectives, and budget are essential. Medical Management programs should focus on identification of patients who could benefit from the individualized attention and assistance of the program. Patients with health conditions that are not currently utilizing “best practices medicine” should receive outreach from the program to determine how the Medical Management services can improve the quality of health care the patient is receiving and/or decrease the cost of the health care the patient is receiving without compromising the quality of health care being provided. Medical Management is an essential component of the BritePath Insights and Rewards strategies.

BritePath benefit strategy focuses on patient outcomes.

Depending upon the funding option and administrator we deploy solutions that can:

- Eliminate rampant overspend by eliminating fraud, waste and abuse within most status-quo plans that can reduce spend by 15%

- Improve Medical Management and Concierge services that can lower spend by 25%

- Aligned PBM contracts reduce Rx spend by up to 40%

- Take advantage of a variety of programs to address outlier claimants

BritePath Plans always strive to:

- Enhance member and employer health care consumer IQ

- Lower out-of-pocket costs

- Improve patient outcomes

- Increase the value of care

- Increase employee retention