There is a Better Way to HRA

What if there was a way to Keep Your Carrier, get Significant Savings while giving your employees Richer Benefits and Higher Quality?

No Disruption

Keep the existing network and carrier.

10-20% Savings

Lower plan cost year one.

Richer Benefits

Lower employee out-of-pocket.

Better Quality of Care

Improved employee health outcome.

The Results

Significant Savings, Improved Health Outcomes and a Better Employee Experience without Changing Networks

43%

Members use search engines to find a doctor.

98%

Employees have a positive experience.

27%

Average employee savings per episode of care.

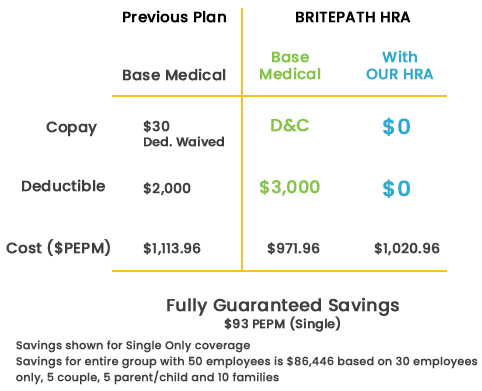

Innovative design overlays on the existing plan to deliver guaranteed savings with lower employee out-of-pocket costs.

No need to change carrier or network.

Incentive covers member out-of-pocket expenses when employees engage and see a top-performing doctor.

Guaranteed monthly cost includes all claims and administrative fees with shared savings upside.

Setup is simple with customized marketing program and employee education team.

How it Works

Get guaranteed savings of 10-20% with richer benefits and better health outcomes.

1.

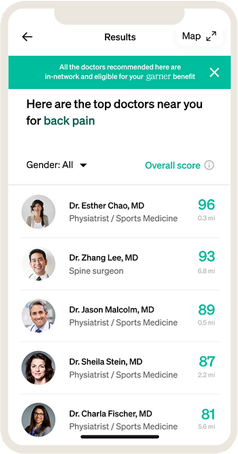

Data identifies the top-performing doctors that produce improved health outcomes and lower total claims.

2.

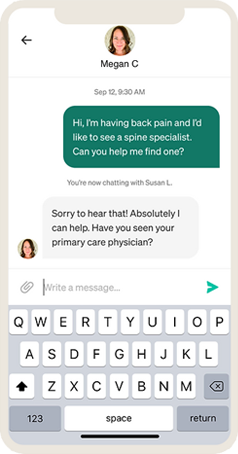

The Concierge team and doctor search tool make it easier to find top-performing doctors who are in your existing network.

3.

The HRA covers the employees’ out-of-pocket medical bills when they engage and see a top-performing doctor.

Frequently Asked Questions

Health Reimbursement Arrangements (HRAs) are employer-funded group health plans from which employees are reimbursed tax-free for qualified medical expenses up to a fixed dollar amount per year. Unused amounts may be rolled over to be used in subsequent years. The employer funds and owns the arrangement.

A Traditional HRA is a strategy focused solely on the insurance costs but it does not address the top two issues with healthcare in the US; accessing the best care and avoiding the steerage of the healthcare systems that refers to the highest cost providers, not the highest quality.

By bundling a resource that combines the largest provider database in the US with custom plan design that incentivizes members for using the best doctors, we are able to maximize savings but focus on high-quality care and deliver superior benefits to members.

Yes, it can overlay onto any existing carrier or third-party administrator network.

No, employees must decide if they wish to use the HRA or their FSA to reimburse their medical expenses.

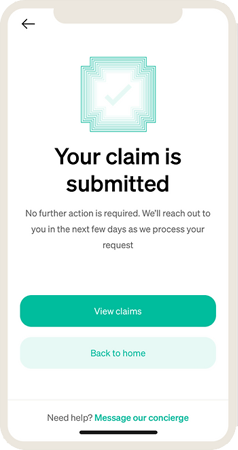

The plan offers a variety of ways for members to get reimbursed. It can connect to the carrier directly, or members can easily submit their claims via the mobile app or website.

No, this plan is an HRA and is not taxable to the members.

Members are encouraged to contact the concierge to determine whether their existing providers meet standards of approval, but generally members may continue to see their existing primary care doctors or specialists which they are in active treatment with.

At the present time, this product is available to employers with 50 or more enrolled employees on their medical plan.