- About the Client:

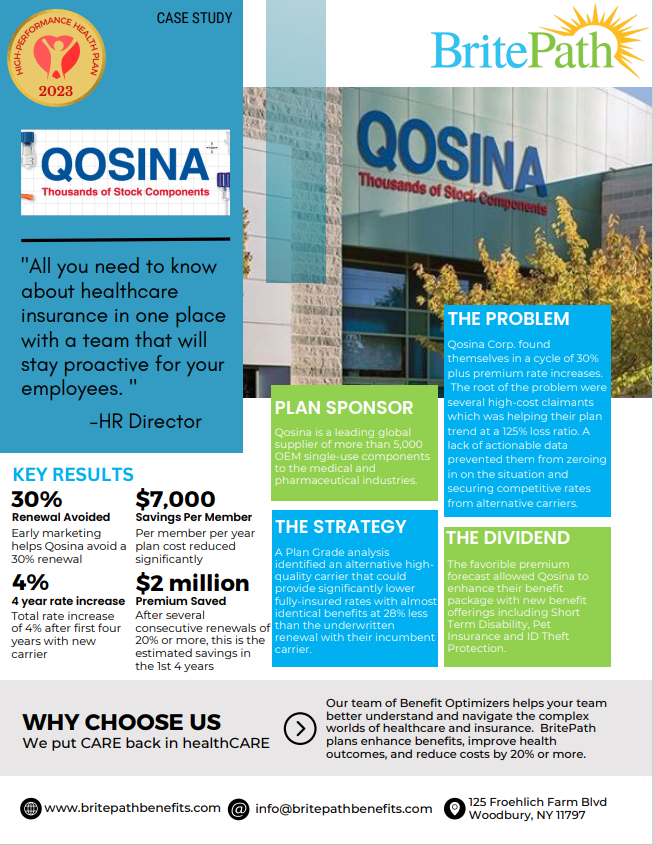

Qosina is a leading global supplier of more than 5,000 OEM single-use components to the medical and pharmaceutical industries. Their mission is to provide the best customer experience possible by helping their customers find, order, and receive quality medical components quickly and accurately. They support innovation by helping medical device engineers get their products to market faster and more efficiently. Qosmedix is a global, full-service provider of wholesale beauty supplies for the cosmetic, skin care and fragrance industries. Their vast inventory features high quality spa and salon products for beauty professionals.

Our relationship with Qosina Corp. began post-renewal in June 2019 after a series of 20%+ increases with limited ability to control costs.

Our focus was on obtaining claims information to identify the source of the unusually high medical and Rx claims. Our team experienced the typical resistance from the incumbent carrier, yet we were able to obtain the data needed to prepare analysis.

The HR team at Qosina and our advisors developed four main goals:

- Evaluate Member Contributions Strategy

- Minimize Member Disruption

- Take advantage of alternative underwriting protocols

- Reassess current plan designs

- Approach:

Qosina and GPI evaluated the existing plan designs, contribution structure, member allocation and did a market evaluation of the existing fully

The incumbent carrier responded to market analysis with a projected 30%+ renewal due to claims trending at a 125% loss ratio.

- Year One Results:

An early rewrite to an alternative carrier with favorable UW provisions for the applicable market segment helped the plan and members avoid a $600k+ increase and almost certain benefit and contribution disruption.

Plan options were reduced from three to two with clearer distinction between the High and Low plans. Copays, Deductibles and Out-of-Pocket limits flowed more clearly, and members more easily distinguished the best plan option for themselves.

The favorable premium forecast allowed Qosina to enhance their benefit package with new benefit offerings including Short Term Disability.

To support Qosina’ s leave of absence management needs several lines of coverage were moved to Guardian including Statutory NY Disability, Short-Term and Long-Term Disability.

The first-year medical renewal of minus .07% reflected the advantageous underwriting methodology and re-supported the transfer of coverage mid-year.

No benefit or premium contribution change was necessitated at renewal. This was especially rewarding in the midst of the current Coronavirus pandemic.

The transformation of the plan from status quo to high-performance has been nothing short of remarkable.

Since our team approach started in 2019, the Qosina plan has had significant successes. Gaining control of out-of-control premiums was easier than expected. Enhanced benefits make recruiting and retaining talent easier which is especially important in the growth mindset of the organization.

- Advanced Reporting & Analytics

The next phase will focus on the introduction of proprietary technology that allows our benefit team and Qosina’ s leadership to gain insights in to the medical and Rx claims and evaluate alternative cost control/benefit enhancement opportunities, as well as alternative funding options available to groups of their size.

Optional cash Price Rx option

A cash price alternative to the embedded Rx benefit can help members avoid unnecessary cost at the pharmacy. Carrier embedded pharmacy benefits are plagued with spread prices and rebates that artificially inflate premiums and member OOP costs. The BritePath Rx option helps control runaway claims.

On the Horizon:

Navigation tools so members are better equipped to make informed health care decisions, avoid unnecessary out-of-pocket costs and be better ambassadors of the organization.

Pharmacy Cost Analysis with true pass-through model projected to reduce the Rx spend by 30-40% leveraging enhanced capabilities such as copay assistance, lower ingredient cost, and securing rebates currently flowing to their PBM.

Partial Self-Insurance

When appropriate a shift from fully insured to self-insurance can help Qosina eliminate the artificially inflated costs and premiums associated with status quo fully insured plans.