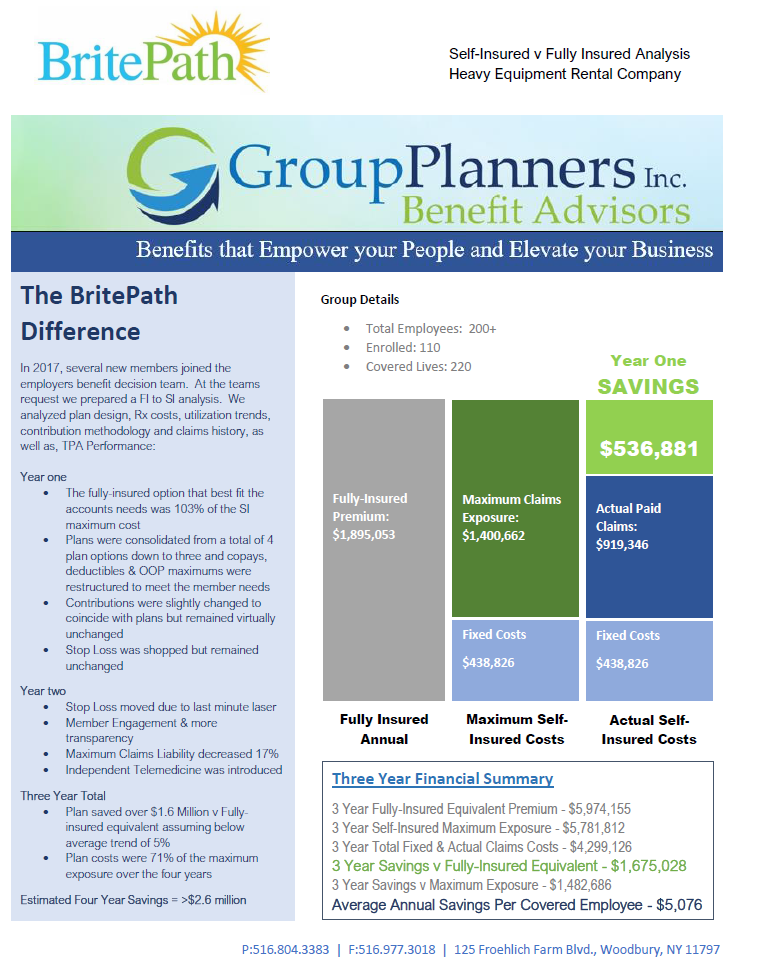

Group Planners Inc. helps Heavy Equipment Rental Company save over $1.6 million over a three year period.

In 2017 our client asked us to go to market to see if a fully insured plan could compete with their already existing self-insured plan. There was concern that the perceived risk associated with self-insuring wasn’t worth it. Our team aggressively marketed with all top tier national carriers. The results returned a best fit fully-insured option priced at 103% of the self-insured maximum exposure. After discussions focused on differentiators such as tax advantages, retention, pooling charges and expected versus maximum claims a final decision was made to remain self-insured.

A recent three year analysis shows remarkable results. Year one savings versus the fully-insured equivalent was $536k. Year two saw a estimated savings of $691k and year three close to $450k. We used a conservative year over year FI increase of 5% which is less than the national average.

The attachment factor (Maximum claims expsoure) dropped 17% in year three and maximum costs dropped by $230k.

2020 is setting up be a banner year. Of course, COVID-19 thus far has resulted in significantly lower than expected claims due to a significant drop in non-essential health care. Plan YTD the group is running at 48% of their aggregate liability. Current projections reflect a savings of over $900k compared to the estimated fully-insured equivalent rates. That would bring the four year savings to jut over $2.6 million.

The standalone telehealth solution implemented in 2017 proved to be timely and ensured no health care was unattainable for their members.

While these savings may not be typical it is a great example of how a well run self-insured plan can save an employer and their members. The only question is what would your company do with this savings? How many widgets would you have to sell to make a net profit of $2.5 million?